HIGHLIGHTS

- Fonepay and LankaPay sign MOU to develop an interoperable digital payment system between Nepal and Sri Lanka.

- Nepalis in Sri Lanka and Sri Lankans in Nepal can now use their mobile banking apps across borders for seamless transactions.

- Fonepay’s latest international partnership with LankaPay adds to its existing collaborations with Visa, China UnionPay, Alipay, and NPCI.

Nepali citizens in Sri Lanka will now be able to make payments easily using the Nepali mobile banking and payment application.

Fonepay, Nepal’s largest interoperable payment network, and LankaPay (former LankaClear), Sri Lanka’s national payment network, signed a memorandum of understanding (MOU) on Wednesday (May 31, 2023) to develop an interoperable digital payment system between the two countries.

The MOU was signed by Diwas Kumar Sapkota, the CEO of Fonepay, and Channa de Silva, the CEO of LankaPay, in the presence of the Chief Guest, Ms. B. Nilusha Dilmini, Charge d’Affaires, a.i., and Head of the Chancery, Sri Lanka Embassy in Kathmandu; Mr. Daniel D. Shrestha, Director of Group Strategy, F1Soft Group; and Mr. Biswas Dhakal, Chairperson, Fonepay.

“Today’s signing ceremony on building an interoperable network between LankaPay and Fonepay is just the starting point for this partnership,” emphasized Diwas Sapkota, CEO of Fonepay, during his speech at the MOU signing ceremony.

He highlighted the shared recognition of Fonepay and LankaPay regarding the significance of creating a seamless, secure, and convenient payment ecosystem.

Sapkota further expressed, “We shall enable the users of Fonepay and LankaPay to transact effortlessly in the days ahead. We also believe that interoperability will open up new avenues for collaboration, enhance cross-border trade, and enable businesses and individuals to thrive in the interconnected digital economy.”

ALSO READ: Govt. Imposes Rs. 10,000 Tax on iPhones and Phones Above 1 Lakh Brought from Abroad

With the implementation of this system, both Nepalis in Sri Lanka and Sri Lankans in Nepal can use their respective mobile banking and payment applications within the interoperable payment network of Fonepay and LankaPay to make purchases in both countries.

To elaborate further, Sri Lankan citizens traveling to Nepal can now easily make instant payments to numerous merchants within the Fonepay network using the QR code feature through the authorized mobile application by LankaPay. Similarly, Nepali citizens traveling to Sri Lanka can enjoy the same convenience by utilizing Fonepay-authorized payment applications.

“With the strategic partnership that we just entered into with Fonepay, we aim to leverage our combined expertise and technology to empower the people of both nations,” stated Channa de Silva, CEO, LankaPay.

Silva further expressed, “Together, we will work to build a robust and interconnected financial infrastructure that will benefit individuals, businesses, and governments in both nations.

We are looking forward to working closely with all stakeholders in Nepal, including the central bank of Nepal, financial institutions, mobile network operators, and fintech companies, to develop a comprehensive and interoperable financial ecosystem with our partnership with Fonepay,”

Daniel D. Shrestha, Director of Group Strategy of F1Soft Group (parent company of Fonepay) expressing the group’s intent to go global, said, “This MoU signing with Sri Lanka’s largest payment network is part of our philosophy and long-term strategy to try and replicate the successes we have jointly achieved along with our partner BFIs and other actors of the ecosystem since our inception in 2004 in Nepal, now outside of Nepal.

In our pursuit of international expansion, we are confident that we will not just have opportunities to take our homegrown technologies and know-how in the international market, but we will also have ample opportunities to bring in internationally successful technology solutions and know-how to Nepal.”

ALSO READ: ISPs in Nepal Quietly Raise Prices of Their Base Internet Plans

Fonepay

Fonepay, a subsidiary of F1Soft Group established in 2019, operates as a payment system operator facilitating inter-bank person-to-person (P2P) and person-to-merchant (P2M) transactions through its interoperable network and mobile platforms.

Regulated by Nepal Rastra Bank (NRB), Fonepay holds the distinction of being the first mobile payment network to be licensed by NRB as a payment system operator (PSO). Additionally, Fonepay is Nepal’s pioneer non-card-based PSO to achieve PCI DSS certification.

The Fonepay network has the participation of 95% of the Nepal BFIs, and PSPs and more than 50% of the total registered businesses, totaling 1.2 million merchants and with adoption by more than 20 million users.

“Fonepay has partnered with multiple international players over the last 3 years,” stated Biswas Dhakal, Chairperson of Fonepay.

Dhakal further shared, “We have partnered with Visa for seamless Visa and Fonepay integration, China UnionPay, Alipay, and neighboring country India with NPCI. This partnership with Sri Lanka is another milestone we have achieved.

We have made a commitment that within 45–60 days, this partnership will enable live transactions in cross-border country QR payments

This marks a historical step towards achieving interoperability in the digital payment space not only for Fonepay but for the entire country. The interoperability between Fonepay and LankaPay is not just about convenience; it is a catalyst for economic growth. We would like to thank the Central Bank of Nepal for its support in realizing our ambition to establish a cross-border payment network with Lankapay.

We also urge the two governments to work on intensifying efforts to increase cross-country tourism, trade, and commerce now that we will have a foundation of interoperable payment systems between the two countries.”

LankaPay

LankaPay, initially established in 2002 as the national cheque clearing house by the Central Bank of Sri Lanka, operates as a digital payment service provider in Sri Lanka under LankaClear (Pvt) Ltd., a joint venture between the Central Bank and commercial banks.

As a national payment network, LankaPay facilitates transactions among various financial institutions and payment service providers in the country. It ensures interoperability, enabling customers to easily transfer funds and make payments across different platforms within Sri Lanka.

LankaPay offers a comprehensive range of payment services, including real-time interbank fund transfers, cheque clearing, online and mobile banking, electronic bill payments, direct debit and credit services, and ATM services.

In November 2022, LankaPay joined the Asian Payment Network, allowing seamless cross-border transactions across 12 countries in the Asia Pacific Region. In 2023, the collaboration with UnionPay International empowered UnionPay app users to conveniently scan and pay at LankaQR merchants nationwide.

-

Yamaha Blue Fest Kicks Off in Kathmandu: Exchange Any Bike with Exciting OffersHIGHLIGHTS Yamaha Nepal kicked off the Yamaha Blue Fest with exciting offers on bikes and…

-

Redmi A5 Arriving Soon in Nepal: Lowest in Price, Highest in Refresh RateHIGHLIGHTS Redmi A5 4G price in Nepal could be Rs. 11,999 (3/64GB) and Rs. 13,999…

-

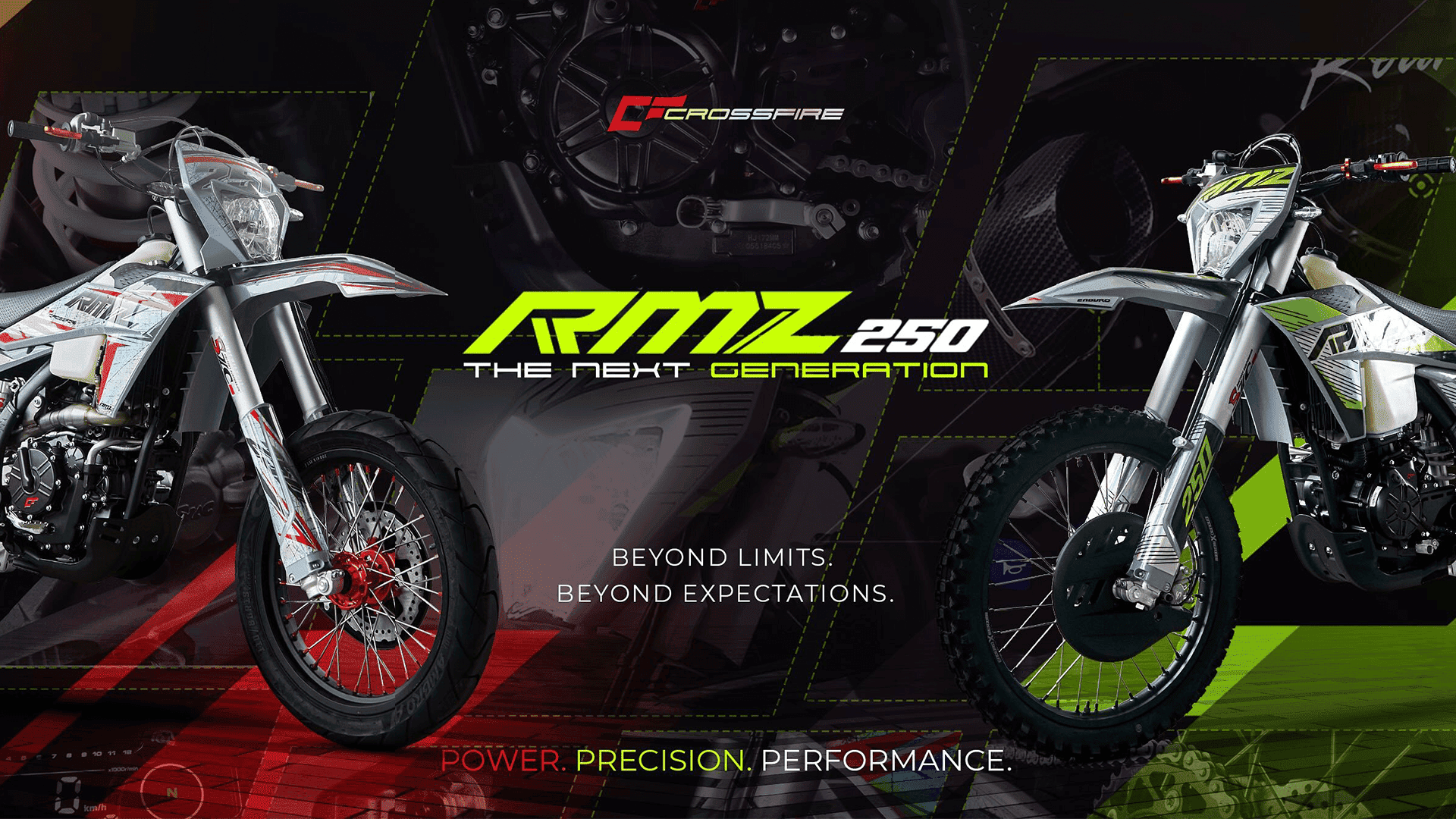

Crossfire RMZ 250 Dirt Bike Officially Launched in Nepal: What’s New?HIGHLIGHTS Crossfire RMZ 250 price in Nepal is Rs. 8.59 Lakhs. RMZ 250 is the…